Wealth Management

Overview

We have successfully designed, implemented, and managed investment portfolios since 1982. Our wealth management services include both investment management and comprehensive financial planning and advice. As a discretionary advisor, we obtain full investment authority in our clients accounts.

We allocate our client's funds to the investments that are right for them. We use customized model allocations based on individual factors including, risk tolerance, liquidity timeline, social consciousness, and many other factors.

We maintain strategic relationships with Charles Schwab & Company (Schwab) and Black Diamond, two companies that power our wealth platform:

Charles Schwab & Company (Firm’s Custodian) - Schwab is an industry-leading custodian in charge of holding and safeguarding client assets. Schwab Advisor Services provides WMS Advisors, LLC with support in areas such as compliance, technology, wealth management services, research, and access to a wide range of investment products and expertise.

Black Diamond (Technology Partner) - This software powers the behind-the-scenes work that we do with your accounts and portfolio. This includes quarterly and on-demand statement generations, performance reports, asset allocation reviews, portfolio rebalances, billing, and many other features. In addition, the supporting us as advisors, the platform also has a state-of-the-art client website and mobile application.

Investment Philosophy

At WMS Advisors, LLC, our investment philosophy is to develop a globally diversified investment portfolio while keeping costs low, minimizing taxes, and reducing market risks. We add market factors and sector exposure to our portfolios that are designed to help generate long-term growth on a risk-adjusted basis. These asset allocation models are designed to lower portfolio volatility (risk) through diversification and help clients invest for future goals including retirement, college, lasting wealth, or a sustainable income stream. We perform portfolio rebalancing on a quarterly, semi-annual, or annual basis to keep the investments consistent with their target allocation. In summary, we want our client’s investments to work together so we can build a financial plan to meet their future needs.

Sample Managed Portfolio Models

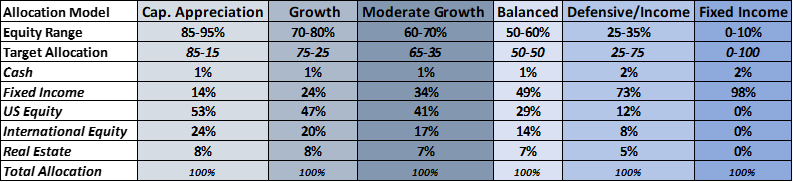

This is an illustration of our six (6) internally developed and managed portfolio models built primarily using exchange-traded funds (ETFs). These funds, which contain a basket of individual stocks or bonds, are low-cost investment vehicles that provide diversification while also allowing us to capture global investment opportunities across the traditional asset classes of equities and fixed income. We also use alternative asset class investments in some portfolios, depending on our client’s unique circumstances.

Wealth Management Fee Schedule

We charge a percentage of assets under management debited quarterly from your investment accounts. This fee includes portfolio management, goal‐based planning, and coordination around tax, charitable, and estate planning. Below is our current fee schedule:

Learn More

Are you ready to take the next step? If so, please click the link below to get started, and we’ll be in touch to schedule an introductory meeting.

Thank you very much for your interest in WMS Advisors!